What to Do If a Car Insurance Company Denies Your Claim in Oregon

Dealing with a car accident is stressful enough – facing a claim denial from the insurance company can make it even worse. Unfortunately, this situation is not uncommon for drivers in Oregon’s Portland metro area. Understanding what to do if a car insurance company denies your claim is crucial so you can protect your rights and seek the compensation you deserve. This comprehensive guide will explain the common reasons claims are denied, the steps to take after a denial, and your options under Oregon law (including appeals and possible legal action). We’ll also address frequently asked questions such as the odds of winning an insurance appeal, whether you can sue for a wrongful denial, and more.

Oregon-Specific Context: Oregon is an at-fault state for car insurance, which means the at-fault driver’s insurer is typically responsible for covering accident damages. Oregon law also requires every auto policy to include Personal Injury Protection (PIP) and Uninsured Motorist coverage, which provide additional protections. Oregon’s insurance regulations and consumer protections play a big role in how insurers must handle your claim. In the Portland metro area – with its busy highways like I-5 and I-84 – accidents happen daily, so it’s important to know how to respond if an insurance company unfairly rejects your claim.

Common Reasons Car Insurance Claims Are Denied

Before diving into the steps to take, it helps to know why insurance claims get denied in the first place. Insurance companies in Oregon (and elsewhere) cite a variety of reasons for denying car accident claims. Some common reasons for denial include:

- Policy Lapses or Coverage Issues: The insurer may claim the policy wasn’t active at the time of the accident, or that the driver was excluded from the policy. If your policy lapsed (e.g. for non-payment) or the at-fault driver was uninsured, a claim can be denied on that basis.

- Damages Not Covered or Excluded: The type of loss might not be covered under the policy. For example, the insurer might argue that the accident falls under an exclusion (such as using the vehicle for rideshare without proper coverage) or that you only had liability coverage and no collision coverage for your own damages.

- Late Reporting or Filing: Insurance policies require prompt notification of accidents and timely filing of claims. If you waited too long to file the claim, the company might deny it, citing failure to report the accident within a reasonable time.

- Paperwork Errors or Missing Information: Something as simple as an incomplete claim form or missing documentation (police reports, medical records, etc.) can lead to a denial. The insurer might say you did not adequately fill out paperwork or provide needed information, so they closed the claim.

- Damages Below Deductible or No Injury: If you’re making a claim under your own policy (for example, collision or PIP coverage), and the damages don’t exceed your deductible or you were not actually injured, the claim might be rejected as not meeting the policy’s threshold.

- Disputed Liability or Facts: In many cases, especially when you file a claim against another driver’s insurance, the insurance company may dispute who was at fault. They have the right to investigate the accident and may deny responsibility if they believe their driver was not actually liable. Similarly, they might argue that your injuries were pre-existing or that the accident didn’t cause them, which can lead to denial of injury claims.

- Failure to Mitigate or Policy Violations: An insurer could claim you didn’t mitigate damages (for example, you didn’t seek prompt medical treatment or secure your vehicle from further harm), or allege you violated policy terms. In Oregon, for instance, if you refuse to cooperate with the insurance company’s investigation or give a recorded statement (when required by your policy), they might use that as justification to deny the claim.

- Insurance Company Error or Bad Faith: Sometimes, frankly, insurers make mistakes or act in bad faith by denying a valid claim without a good reason. They might hope the claimant doesn’t challenge the denial. Oregon regulators recognize this can happen – state law prohibits insurers from denying a claim “without conducting a reasonable investigation” or without a valid cause. (We’ll discuss Oregon’s bad faith insurance laws in more detail later.)

Knowing the reason given for your denial is important, because it will guide your next steps. Always read the denial letter carefully. Oregon law requires insurance companies to provide a prompt and clear explanation for why they denied your claim, including the policy provision or law they relied on. Make sure you have this explanation in writing; it’s your starting point for any appeal or further action.

What Steps Should You Take If a Claim Is Denied?

Facing a claim denial can be overwhelming, but don’t panic. A denial is not necessarily the end of your claim. There are several steps you should take immediately after receiving a denial from the car insurance company:

- Review the Denial Letter and Policy: Carefully examine the denial notice and your insurance policy (or the at-fault driver’s policy, if available). Understand the exact reason they gave for denial. Is it a specific exclusion? A factual dispute? Knowing why they denied the claim will inform your response. Remember, Oregon law mandates the insurer to explain the basis of the denial, so you have a right to that information in plain terms.

- Gather and Organize Evidence: If the denial is due to lack of evidence or a dispute of facts, gather any documentation that supports your claim. This may include the police accident report, photographs of the crash scene and damage, medical records linking your injuries to the accident, witness statements, and repair estimates. The more evidence you have, the stronger your case when you challenge the denial. For example, if they denied liability, witness statements or traffic camera footage might refute the insurer’s position.

- Contact the Insurance Adjuster (and Ask Questions): It’s often helpful to call the insurance adjuster or claims representative who handled your case. Politely ask for clarification about the denial. Sometimes, you can address a denial by providing additional information. For instance, if your claim was denied for missing paperwork or an administrative issue, submitting the required documents promptly could get the decision reversed. Take notes during any phone call – note the date, the person’s name, and what was discussed.

- Request a Supervisor Review or Internal Appeal: If the initial adjuster sticks by the denial and you believe the decision is wrong, ask to escalate the claim. Many insurance companies have an internal appeals process or at least allow you to request a higher-level review. This might involve writing a formal appeal letter explaining why you believe the denial was incorrect, and providing any new evidence or arguments. Be sure to do this within any stated deadlines (the denial letter or policy may specify how long you have to appeal internally). Keep a copy of all correspondence. It’s worth noting that a denial can sometimes be overturned at this stage – especially if it was due to a mistake or if you present new facts.

- File a Complaint with the State of Oregon (if needed): If your claim is still wrongfully denied after an appeal, or if the insurer is acting in bad faith or unreasonably delaying, you can get the Oregon Division of Financial Regulation (DFR) involved. This is the state agency that regulates insurance companies (formerly known as the Insurance Division). You can file a complaint online or contact the DFR’s Consumer Advocacy hotline for help. The DFR can investigate consumer complaints and sometimes help facilitate a resolution. While they won’t litigate your claim, the fact that the state is reviewing the issue can pressure an insurer to behave. In Oregon, a pattern of unjustified denials can lead to regulatory action – for example, if an insurer is found to be violating Unfair Claim Settlement Practices rules by denying claims without just cause, it’s taken very seriously.

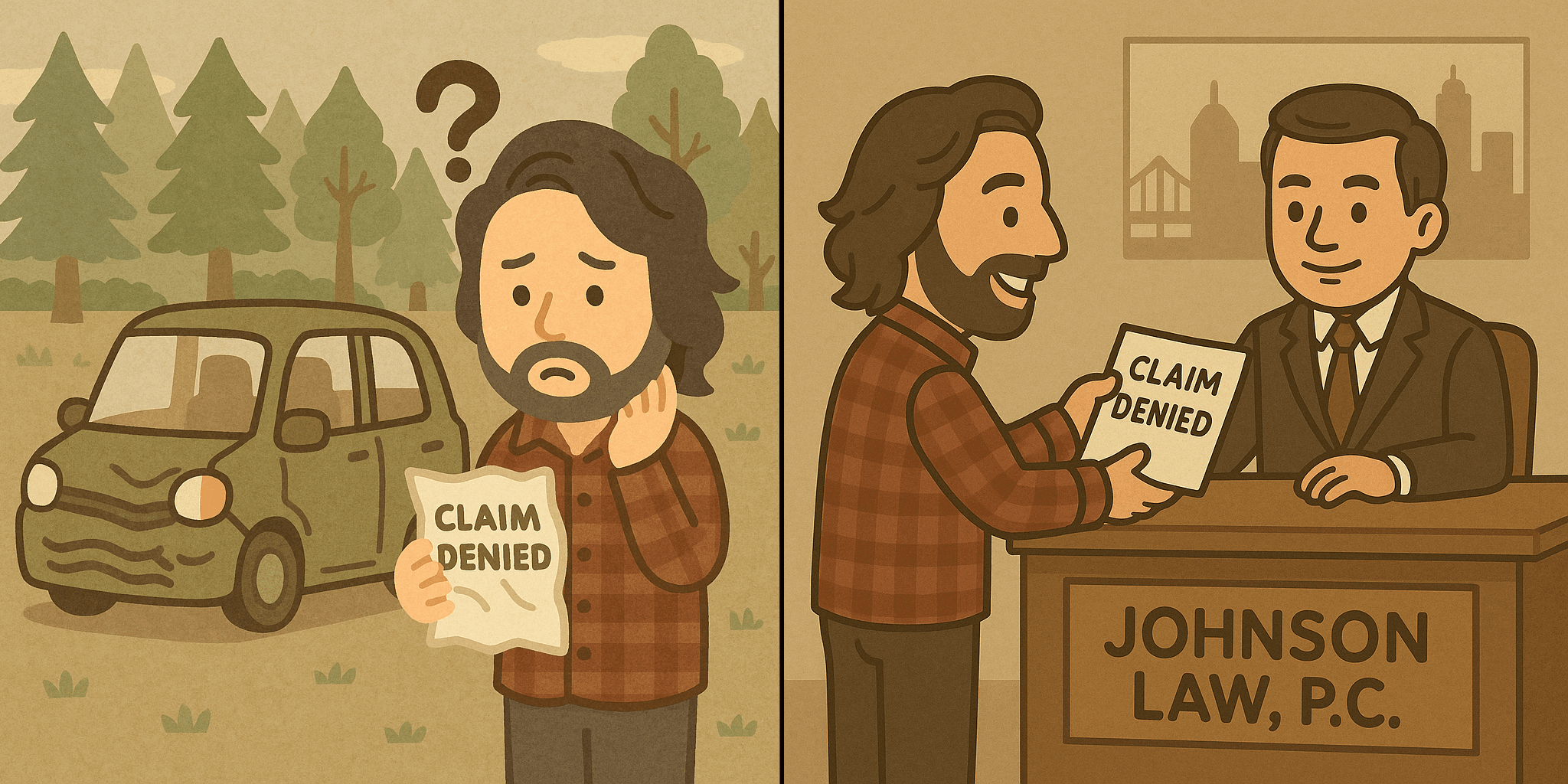

- Consider Consulting an Attorney: If the amount at stake is significant, or the insurance company continues to deny a claim you strongly believe is valid, it’s wise to consult a personal injury attorney experienced in insurance disputes. Many Oregon personal injury lawyers (like Johnson Law, P.C.) offer free initial consultations. An attorney can evaluate whether the denial is lawful and advise on next steps. Sometimes, simply having a lawyer step in – by writing a demand letter citing Oregon law or threatening a lawsuit – can lead the insurer to reconsider a denial. Remember that insurance companies have teams of adjusters and lawyers, and if you’re going up against a firm denial, having your own legal advocate evens the playing field.

- Keep Track of Deadlines (Statute of Limitations): A denied claim often means you might have to pursue legal action to get paid. In Oregon, the statute of limitations for car accident injury claims is generally two years from the date of the accident (for injury or wrongful death) and often six years for property damage. (There are exceptions, so get legal advice on the exact deadline for your case.) If you’re approaching the time limit and the insurer still hasn’t reversed the denial or offered a fair payment, you may need to file a lawsuit to preserve your rights. Don’t let the clock run out because you were tied up in lengthy appeals or negotiations.

- Don’t Settle for Less (Unless it’s Fair): Sometimes as a response to an appeal, an insurance company might offer a compromise – for example, a partial payment or a low settlement on a claim they initially denied. Evaluate such offers carefully. If it covers your losses adequately, it might be worth avoiding further hassle. However, do not feel forced to accept a token amount if you’ve legitimately suffered larger damages. Insurers have been known to “low-ball” claimants (offering much less than the claim is worth) hoping they’ll take it and go away. Oregon considers offering substantially less than fair value as a potential unfair practice if it forces people into litigation. If the offer is unreasonable, continuing with your appeal or seeking legal help is justified.

By following these steps, you give yourself the best chance to get a wrongful denial overturned. Many times, persistence pays off. It’s reported that a surprisingly large number of people simply give up when a claim is denied, even if they have a strong case. Don’t be one of those people – know your rights and advocate for yourself. And if you hit a wall, there are professionals and legal remedies in Oregon that can help, as we’ll discuss next.

What Are the Odds of Winning an Insurance Appeal?

When your claim has been denied and you challenge that decision, you may wonder: What are the odds of winning an insurance appeal? The answer can depend on the specifics of your case, the reason for denial, and how strong your evidence is. While it’s hard to give an exact probability for any individual claim, some data and experience shed light on overall success rates.

The good news is that many insurance denials can be overturned if you have a valid claim and persist through the appeals process. In fact, statistics from other insurance sectors show that appeals often succeed. For example, in the health insurance realm, it’s estimated that over 50% of appealed claims denials end up being paid or reversed in favor of the customer. Another analysis found that only about half of people whose claims are denied ever appeal – but of those who do appeal, roughly 50% win the appeal and get the claim paid.

What does this mean for your car insurance claim? It suggests that the odds are far better than zero, and possibly quite decent, if you take the time to appeal. Insurance companies sometimes deny claims initially for questionable reasons, but when confronted with a well-organized appeal (especially one highlighting strong evidence or applicable law), they may change their decision rather than risk further conflict or regulatory scrutiny.

However, it’s important to set realistic expectations. Not every appeal will succeed. If the insurance company had a correct and solid reason to deny (for example, the loss truly wasn’t covered by the policy, or liability is genuinely unclear), then an appeal might not change the outcome. Additionally, each case is unique – a simple paperwork issue can be fixed easily, whereas a complex dispute (like a he-said/she-said accident with no witnesses) might be harder to overturn without new evidence or a court’s intervention.

Tips to improve your odds: To maximize your chances of a successful appeal, make sure you provide any missing information the insurer noted, correct any errors, and clearly explain why their denial is mistaken. If you can reference Oregon law or policy language that supports your position, do so. For instance, if the insurer denies your uninsured motorist (UM) claim by arguing you weren’t entitled to it, but you know the at-fault driver was indeed uninsured (which is not rare – about 12.3% of Oregon drivers are uninsured as of 2022), you could highlight that fact and the terms of your UM coverage that should apply. Likewise, if they claim you had a lapse in coverage but you have proof of payment, presenting that will bolster your appeal.

Also, if your internal appeal fails, remember that involving a state consumer advocate or an attorney (as noted in steps above) can increase pressure on the insurer. Sometimes the presence of an external party reviewing the denial makes the company more willing to resolve the claim in your favor.

In summary, while there’s no guarantee, don’t assume a denial is final. The odds of winning an insurance appeal are significant enough that it’s usually worth pursuing – roughly half of appeals or more do succeed in getting claims paid. Each step you take to escalate the issue (providing more evidence, complaining to regulators, getting legal help) can further improve your chances. If your claim is valid, you stand a good chance of eventually getting compensated, whether through the insurer reversing its decision or through other means.

Can You Sue an Insurance Company for Denying Coverage?

If you’ve tried appeals and other remedies without success, you might be asking: Can I sue the insurance company for denying my claim? The answer is generally yes – if an insurance company wrongfully denies a valid claim, you can take legal action. However, how and who you sue can vary depending on the situation. Here’s a breakdown under Oregon law:

- Suing Your Own Insurance Company (First-Party Claims): If it’s your insurance company that denied your claim (for example, your PIP, collision, or uninsured motorist coverage claim), you have the right to sue them for breach of contract. Your insurance policy is a contract, and if the insurer doesn’t hold up their end (paying covered claims), you can file a lawsuit alleging they breached the contract by denying your covered claim. In Oregon, insurance companies are also bound by an implied duty of good faith and fair dealing. This means they must treat you fairly and not put their interests above yours in handling the claim. Oregon’s laws explicitly prohibit insurers from refusing to pay claims without conducting a reasonable investigation or without a reasonable basis. They are also required to attempt in good faith to promptly settle claims when liability is clear. If your insurer violated these duties – for example, denying your claim without even investigating properly – that behavior is often termed “bad faith.”Under Oregon law, bad faith insurance practices can have serious consequences. While Oregon historically did not allow a separate lawsuit purely for insurer bad faith in every circumstance, recent legal developments have strengthened consumers’ hand. In fact, the Oregon Court of Appeals and Supreme Court have recognized that violating the Unfair Claim Settlement Practices statute (ORS 746.230) can give rise to a negligence per se claim against the insurer. In plain English, this means if the insurer egregiously violates the claims-handling rules (like denying without a reasonable investigation or without a valid reason), you might be able to sue not just for the contract benefits, but potentially for additional damages (even emotional distress in some cases of egregious conduct) caused by their bad faith.Furthermore, Oregon has a useful law (ORS 742.061) that can make the insurance company pay your attorney’s fees if you sue your own insurer and win more than what the insurer offered before the lawsuit. For example, if your insurer offered you $0 and denied the claim, and you sue and recover anything, they may have to pay your attorney’s fees on top of that. This attorney-fee rule is a strong incentive for insurers to deal fairly – if they drag you through a lawsuit and lose, it gets very expensive for them. Knowing this, many insurers will reconsider a denial once a well-supported lawsuit is filed or impending.So yes, you can sue your insurance company for a wrongful denial. This would typically be filed in state court (likely in the county where you live or where the accident occurred, such as Multnomah County for Portland residents). Often these suits are for breach of contract and, if applicable, for bad faith or statutory violations. If you win, you can get the claim amount owed, possible interest, possibly your legal fees, and in extreme cases maybe even punitive damages (punishment) if the conduct was malicious. Most cases don’t get to punitive damages in Oregon insurance claims, but the threat is there for truly bad behavior.

- Suing Another Driver’s Insurance Company (Third-Party Claims): If your claim was against someone else’s insurance (for example, you were hit by another driver and their insurer denied your claim), the situation is a bit different. You typically cannot directly sue the other driver’s insurance company for denying the claim. This is because you don’t have a contract with that insurer – their obligations are to their own policyholder. However, you are not without recourse. In this scenario, your legal option is usually to sue the at-fault driver themselves for your damages from the accident. When you sue the at-fault driver, their insurance company is obligated to defend them (if the claim is within the policy coverage) and pay any settlement or judgment up to the policy limits.In practical terms, suing the other driver often forces the insurance company’s hand. If you have a strong case that the other driver was at fault and you suffered damages, the insurer may choose to settle with you rather than incur legal costs or risk a court judgment. If they continue to deny liability and you take it to trial – and win – the insurer will have to pay the judgment (up to the policy limit). In Oregon, if an insurance company unreasonably refuses to settle a clear-cut claim against their insured and a jury awards more than the policy limit, the insurance company can even be exposed to additional liability for the excess judgment due to bad faith toward its own insured. (This is more a concern for the insurer if they are clearly at fault. For you as the claimant, it’s leverage: they have an incentive not to let it reach that point.)So while you don’t sue the insurance company directly in third-party cases, filing a lawsuit against the liable party is effectively the way to get the insurance involved properly. It’s advisable to have an attorney for this, because litigation can be complex. Oregon’s courts (like those in the Portland area) have procedures to follow, and an attorney can also negotiate with the insurer’s attorneys to potentially reach a fair settlement before trial.

- Small Claims or Arbitration: If the amount in dispute is relatively small (for example, a few thousand dollars of vehicle damage that the insurer denied), you might consider Oregon’s small claims court or an arbitration proceeding. Oregon small claims courts allow claims up to a certain dollar limit (often $10,000, but check current limits) and are designed for individuals to navigate without formal attorneys. This can be a faster, cheaper way to get a judgment that you can then enforce. Additionally, some insurance policies (especially for uninsured/underinsured motorist claims) contain arbitration clauses requiring or allowing disputes to be resolved by an arbitrator instead of court. Oregon law provides for arbitration of UM/UIM claims in some circumstances. Arbitration is like a mini-trial, but less formal. The outcome can be binding on the insurer. If your insurer denied your UM claim, for example, you might be able to demand arbitration as per your policy terms – an attorney can advise on this.

Bottom Line: Yes, you can sue an insurance company for denying coverage unjustly. Oregon’s legal framework gives you tools to hold insurers accountable, especially your own insurance company under a first-party claim. Insurers must treat your claim with the same care as if it were their own situation, and if they don’t, the courts can make them pay what they owe and more. Of course, a lawsuit should usually be a last resort – it can take time and the outcome isn’t guaranteed. But the possibility of legal action is an important bargaining chip.

Many insurers will settle valid claims before it gets to a courtroom, once they see you’re serious (often after you hire a lawyer). If you do have to sue, know that courts in Oregon commonly handle these disputes, and a favorable settlement or judgment can not only compensate you but also potentially cover your attorney fees in a first-party case. Always consult with a legal professional to evaluate the strength of your case before proceeding with a lawsuit.

What Do You Do If Your Insurance Claim Is Rejected?

“Claim denied” and “claim rejected” usually mean the same thing – the insurance company has refused to pay. But let’s interpret this question as asking: What if you’ve tried everything and the insurance company still won’t budge? In other words, what should you do if your insurance claim remains rejected after appeals or if the denial is final?

If you find yourself at the end of the road with the insurer, here are some final steps and considerations:

- Re-evaluate the Insurer’s Reasoning: Double-check the insurer’s justification one more time. Is there any merit to it, or is it completely unfounded? If there is some legitimate issue (for example, a coverage gap you overlooked), you might have to accept that outcome. However, if you firmly believe the claim should be covered, use that conviction to fuel your next steps.

- Seek a Second Opinion (Legal Consultation): If you haven’t already, definitely talk to a personal injury or insurance attorney about the rejected claim. Many attorneys in Portland and Oregon offer free consultations. They can tell you if the insurance company’s reason is one that can be challenged successfully. Sometimes, an attorney will spot angles you didn’t – perhaps a policy interpretation issue or a violation of Oregon’s insurance regulations – that can turn the tables. For example, maybe the insurer says you weren’t covered because you were using your car for work, but an attorney knows of an Oregon case that interprets that exclusion more narrowly. A legal opinion will help you decide if pursuing a lawsuit is worth it.

- File a Lawsuit (or Demand Arbitration): As discussed above, when an insurance claim remains rejected, the ultimate recourse is to file a lawsuit (or initiate arbitration if applicable). At this stage, you or your attorney will prepare a complaint outlining how the insurer (or the at-fault party) wronged you by failing to pay the claim. Once the lawsuit is filed and the insurance company is officially served, one of two things usually happens: either settlement talks heat up – because now the insurer knows you mean business – or the case proceeds through litigation. If it proceeds, there will be discovery (exchange of evidence), potential mediation, and possibly a trial to have a judge or jury determine if you should be paid. The prospect of a public trial can incentivize an insurer to offer a fair settlement, especially if they have any bad faith exposure. Remember, Oregon law frowns on insurers forcing claimants into litigation by offering much less than what’s owed, so simply by suing, you might have strengthened your position.

- Leverage Oregon’s Consumer Protections: If not already done, ensure that you have filed a complaint with the Oregon DFR about the claim being unfairly rejected. Even if you’re suing, a regulatory complaint can run in parallel. The state might not resolve your individual claim, but if the insurer has a pattern, your complaint adds to that record. In some cases, insurers have reversed decisions during a regulator’s investigation to “make the complaint go away.” At the very least, the outcome of your complaint (the DFR will usually give you a written response after they review the case) could be useful evidence. For instance, if the DFR finds that the insurer’s denial was not justified under policy terms, that letter could be powerful in settlement negotiations or court.

- Consider Media or Public Pressure (Rarely Used): This is not common, but occasionally, egregious insurance denials (especially involving clear injuries or large losses) get media attention. Local news consumer advocates or media in Oregon might highlight a story of a claimant being mistreated. Insurance companies hate bad publicity. We mention this as a last resort tactic – it’s not appropriate for every case, and your attorney would guide you on this – but it has been effective in some instances to shame an insurer into doing the right thing. Again, this is more of an outlier strategy when other options are exhausted.

- Move on (if you must): If all avenues fail – extremely rare if your claim was truly valid – you may have to come to terms with the loss. Maybe the evidence just wasn’t there to prove your claim, or liability was too contested. If a court or arbitrator ultimately sides with the insurer, or if the cost of further fight exceeds the potential recovery, you might have to stop. It’s not fair to have a valid claim unpaid, but it can happen. The hope is that by following the steps in this guide, you will not end up at this point for a legitimate claim.

One thing to never do is simply accept a wrongful rejection without at least challenging it. You owe it to yourself to try the appeals, complaints, or consultations described above. Insurance is meant to be a safety net. In Oregon, you pay good money for your premiums (the average Oregon auto insurance cost in recent years has climbed above $1,100 per year, reflecting the promise of coverage). If an insurance company is failing to uphold their promise, you have every right to fight back. Many people are successful in getting denials overturned when they take action.

Finally, keep in mind that each claim and case has its own nuances. Don’t lose hope because of one rejection. Persistence, knowledge of your rights, and professional guidance can turn a “no” into a payout. If you find yourself struggling with a rejected claim, consider reaching out to legal professionals who understand Oregon’s insurance landscape.

Oregon’s Bad Faith Insurance Laws and Consumer Rights

It’s worth highlighting in a dedicated section how Oregon law protects consumers against bad faith insurance practices, since this underpins many of the points above. When an insurance company “denies your claim,” it must do so fairly and lawfully. Oregon has adopted strong rules (similar to the national standards) that define unfair claim settlement practices. Here are some key protections and what they mean for you:

- Duty of Reasonable Investigation: Insurers cannot shut down your claim without looking into it properly. By law, an insurer must not refuse to pay a claim without conducting a reasonable investigation based on all available information. This means they should interview witnesses, review medical reports, examine the scene – whatever is appropriate for the claim – before saying “no.” If your claim was denied without an adjuster ever calling you or without inspecting the vehicles, that could violate this rule.

- Timely Decisions and Explanations: Oregon requires insurers to acknowledge and act on claims promptly, and to make decisions in a reasonable time once they have your proof of loss. They also must communicate clearly. Notably, they must provide a proper explanation of the basis for any denial, referring to the facts and policy language that justify it. Vague or generic denial reasons aren’t good enough; you’re entitled to specifics. If you get a denial that doesn’t make sense, that itself might be an unfair practice.

- Good Faith Settlement Obligations: If it becomes reasonably clear that you are owed money under the policy, the insurer must attempt in good faith to settle and pay promptly. They shouldn’t drag their feet or play games when liability is evident. For instance, if the other driver was clearly at fault and your damages are well documented, the at-fault driver’s insurer should not stall endlessly or force you to jump through needless hoops.

- No Low-Ball Offers to Force Litigation: An insurer is not allowed to compel you to file a lawsuit by offering substantially less than what your claim is worth. If they do this as a general practice, it’s considered evidence of bad faith. This rule is basically to prevent insurers from making outrageously low offers expecting that some people won’t bother to sue. If you end up suing and recovering a lot more, that rule comes into play.

- Patterns of Unfair Practices: Oregon’s Department of Consumer and Business Services (DCBS), which includes the DFR, monitors insurers for patterns. If an insurance company racks up a lot of complaints or lawsuits for similar issues, the state can take action. The law even says that an insurer who has a general business practice of unjustified denials – evidenced by a spike in consumer complaints or lawsuits – is engaging in prohibited conduct. In short, companies can get fined, lose their license, or be ordered to change their ways if they keep acting in bad faith.

What do these laws mean for you? They give you leverage. When you write an appeal letter or have your attorney make a demand, citing these obligations can make the insurer think twice. For example, pointing out that “Under ORS 746.230(1)(d) you have a duty to investigate my claim reasonably, yet you denied it without even speaking to my witness” puts them on notice that you know your rights. Often, insurance companies would prefer to resolve your claim than to risk a regulator finding they violated the law or a court siding with you.

It’s empowering to know that Oregon courts support policyholders in many of these disputes. In case law, Oregon judges have stated that an insurer must treat an insured’s interests equal to its own interests when handling claims. That’s a strong affirmation of the principle of good faith. If an insurer prioritizes saving money over paying a legitimate claim, they breach that duty.

Additionally, as mentioned, Oregon’s statute allowing recovery of attorney fees (in many cases) makes it feasible for people to pursue valid claims in court. In some states, people give up because hiring a lawyer would cost more than the claim – but Oregon’s law often shifts that cost to the insurer if the insured was right to sue. This means if you have a solid case, an attorney can take it on knowing that if you win, the insurer pays the fees. This policy ultimately pushes insurers to settle meritorious claims sooner rather than face litigation.

In summary, Oregon’s legal landscape is on your side when it comes to unfair insurance claim denials. These bad faith laws and consumer protections can’t prevent every wrongful denial, but they give you remedies after the fact. Insurance companies are aware of these laws – which is why many do settle claims fairly. If you encounter one that doesn’t, you now know that you have strong tools to fight back.

Turn a Denial into a Fair Resolution

Having a car insurance claim denied in the Portland metro area or anywhere in Oregon can leave you feeling frustrated and powerless. But you now know the key steps and options for what to do if a car insurance company denies your claim. To recap briefly:

- Stay calm and informed: Understand the reason for denial and gather all relevant information.

- Challenge the decision: Through internal appeals and providing additional evidence, you have a decent chance of success – many denials get overturned when properly appealed.

- Use available resources: Don’t hesitate to involve the Oregon Division of Financial Regulation for assistance or to put pressure on the insurer.

- Know your rights: Oregon law requires insurers to act in good faith and can penalize bad faith conduct. You can sue for wrongful denials, and often the law will make the insurer pay for that wrongdoing if you prove your case.

- Get professional help if needed: Especially for significant claims or injuries, contacting a lawyer can dramatically improve your outcome. A personal injury attorney can handle the heavy lifting of dealing with the insurance company and take legal action if necessary, while you focus on recovery.

Always remember, a denial is not the end of the road. Insurance companies deny claims for many reasons – some valid, many not. By being proactive and persistent, you can often turn that initial “no” into a fair settlement or payout. Each case is unique, but the combination of Oregon’s consumer-friendly laws and a determined claimant is powerful.

If you’re in a situation where you’ve tried to work with the insurer and gotten nowhere, it may be time to get a free case evaluation from an attorney. At the end of the day, you shouldn’t have to bear the financial burden of an accident that should be covered by insurance. The law is on your side to prevent that.

Need guidance? Johnson Law, P.C. has experience helping accident victims across Portland and Oregon navigate insurance disputes. We understand the tactics insurance companies use and the legal strategies to counter them. While we hope this guide empowers you to handle a denial on your own, know that professional help is available if you need it. The goal is to ensure you receive the compensation you’re entitled to so you can move forward after an accident.

(Disclaimer: This article is for general informational purposes and is not legal advice. For advice on your specific situation, consult with a qualified attorney.)