Oregon Accident Guide: Legal Rights, Insurance Claims & Post-Crash Steps

Car accidents in Oregon can be overwhelming, but understanding your rights and the proper steps can make a huge difference. This comprehensive Oregon Accident Guide covers what to do immediately after a crash, key Oregon laws, insurance processes, and how to protect your interests. Oregon sees tens of thousands of crashes every year – nearly 50,000 collisions annually, with around 600 traffic fatalities and many thousands injured in recent years. Being prepared with the right knowledge can help you stay safe, comply with the law, and maximize any claims for compensation.

DISCLAIMER

This guide is for informational purposes only and is not intended as legal, medical, or insurance advice. Laws and regulations can change, and while we strive to provide accurate and up-to-date information, some details may become outdated over time. Additionally, every accident case is unique, and the information provided here may not apply to your specific situation.

This guide does not create an attorney-client relationship, and reading it does not constitute legal representation. If you have been in an accident and need legal guidance, we strongly recommend consulting a qualified Oregon personal injury attorney who can evaluate your case and provide personalized advice.

For the latest Oregon traffic laws and insurance regulations, refer to official sources such as the Oregon Revised Statutes (ORS), Oregon DMV, and Oregon Department of Transportation (ODOT). If you are seeking legal assistance, contact our office for a free consultation to discuss your rights and options.

Safety First & Call 911: After a crash, ensure everyone’s safety. Move your vehicle out of traffic if it’s safe to do so and check for injuries. Call 911 to get police and medical help on the scene if anyone is hurt or there’s significant damage. Even for minor accidents, calling the police is wise – an official report can document the incident. Never leave the scene of an accident – Oregon law requires drivers involved in a crash to stop and remain at the scene; failing to do so can lead to hit-and-run criminal charges.

Exchange Information: Exchange contact and insurance information with the other driver(s) involved. Obtain their name, phone number, address, driver’s license number, license plate, and insurance details. Also get contact info from any witnesses. Be polite and helpful, but do NOT admit fault or make apologetic statements about blame at the scene – even saying “I’m sorry” could be misconstrued as admitting liability.

Document the Scene: If you can, gather evidence. Take photos of vehicle damage, skid marks, intersection or road conditions, and any visible injuries. These photos can be crucial evidence later. Note the time, weather, and location of the crash. If police respond, get the officer’s name and report number. Common accident injuries like whiplash, concussions, back and neck injuries, and fractures might not be obvious immediately, so documentation helps if symptoms appear later.

Seek Medical Attention ASAP: It’s important to get medical evaluation as soon as possible, even if you feel okay. Adrenaline can mask pain, and some injuries (like internal injuries or soft-tissue damage) may not show symptoms until hours or days later. Going to the ER or seeing a doctor promptly creates a medical record of your injuries linked to the accident. This not only protects your health but also links injuries to the crash for any insurance claim. Common injuries after accidents include whiplash, back and neck sprains, concussions, broken bones, and contusions. Early treatment can prevent complications and strengthen your injury claim.

Legal Obligations at the Scene: Oregon law requires certain actions after an accident. You must stop and render aid if anyone is injured – this means calling for medical help and, if qualified, giving reasonable assistance. For any collision, you must exchange information (name, address, driver’s license, vehicle ID, insurance) with the other parties. Failing to fulfill these duties (even for a property-damage-only crash) is illegal (a misdemeanor or worse). If the accident caused injury, death, or significant property damage, you are also obligated to report it to authorities (more on reporting requirements below). When in doubt, always call the police; at minimum they’ll help with safely managing the scene and filing a report.

Summary of Immediate Steps: Here’s a quick checklist of what to do immediately after an Oregon car accident:

- Ensure Safety: Move out of harm’s way and check for injuries.

- Call 911: Report the accident and request police/ambulance if needed

- Don’t Leave: Stay at the scene. Leaving can result in hit-and-run charges

- Exchange Info: Swap names, contact info, driver’s license numbers, and insurance details with other driver(s). Also get witness contacts.

- Document Evidence: Take photos of vehicles, injuries, and the scene; note details like weather and time.

- Avoid Admissions: Speak with honesty but do not admit fault or apologize for causing the crash.

- Seek Medical Care: Accept medical help on scene if offered. If not treated on scene, see a doctor as soon as possible after for a check-up.

- Report if Required: If injuries or significant damage occurred, you will need to file an accident report (see Oregon reporting rules below).

By following these steps, you protect both your health and your legal rights in the critical moments after a crash.

2. Oregon Car Accident Laws

Understanding Oregon’s accident laws will help you know your rights and obligations. Here are the key legal concepts specific to Oregon:

At-Fault vs. No-Fault System: Oregon is an “at-fault” state for car accidents, meaning the driver who caused the accident is financially responsible for the damages. Unlike “no-fault” states, Oregon allows injury claims against the at-fault driver’s insurance or filing a lawsuit against the at-fault driver. However, Oregon does require Personal Injury Protection (PIP) coverage (often called "no-fault insurance") on all auto policies, which pays for your own initial medical expenses and lost income regardless of fault

This PIP requirement is an “add-on” to Oregon’s fault system – it ensures you have some immediate benefits after a crash, but it does not prevent you from pursuing a claim against the at-fault driver as true no-fault states do

In short, the at-fault driver (and their insurer) is liable for the damage, but your own PIP can help with short-term needs in the meantime.

Comparative Negligence – 51% Bar Rule: Oregon follows a modified comparative negligence rule (ORS 31.600). This means if you are partially at fault for the accident, you can still recover damages as long as you were not more at fault than the other party. In practice, if you are 50% or less at fault, you can seek compensation (but your award would be reduced by your percentage of fault). If you are 51% or more responsible, you are barred from recovering anything

For example, if you were 20% at fault for a crash (perhaps you were slightly speeding) and the other driver was 80% at fault, you could recover damages, but any settlement or verdict would be reduced by 20%. If a jury found you 55% at fault and the other driver 45%, you would not recover damages because you exceeded Oregon’s 51% fault bar. This shared-fault rule makes it crucial to gather evidence and counter any claims that you were largely to blame.

Statute of Limitations in Oregon: A statute of limitations is the legal deadline to file a lawsuit. In Oregon, the time limit for most car accident injury claims is 2 years from the date of the accident. This two-year statute (ORS 12.110(1)) covers personal injury claims – for example, if you suffered injuries in a crash on July 1, 2025, you generally must file any lawsuit by July 1, 2027. If a claim is not filed before the deadline, you’ll likely lose your right to pursue it in court. (There are a few exceptions, such as the “discovery rule” for injuries not immediately apparent, or if the injured person is a minor or incapacitated, but assume 2 years in standard cases.) Property damage claims (for damage to your vehicle or property) have a longer statute of limitations – typically 6 years in Oregon. Wrongful death claims (if a family member tragically dies in a crash) have a 3-year limit from the date of the injury that caused the death. Importantly, claims against a government entity (like if you were hit by a city bus or other government vehicle) have special rules: you must provide a formal notice of claim within 180 days of the accident, and then file any lawsuit within the standard 2 years. Missing these deadlines can result in losing your rights, no matter how strong your case – courts strictly enforce the statute of limitations.

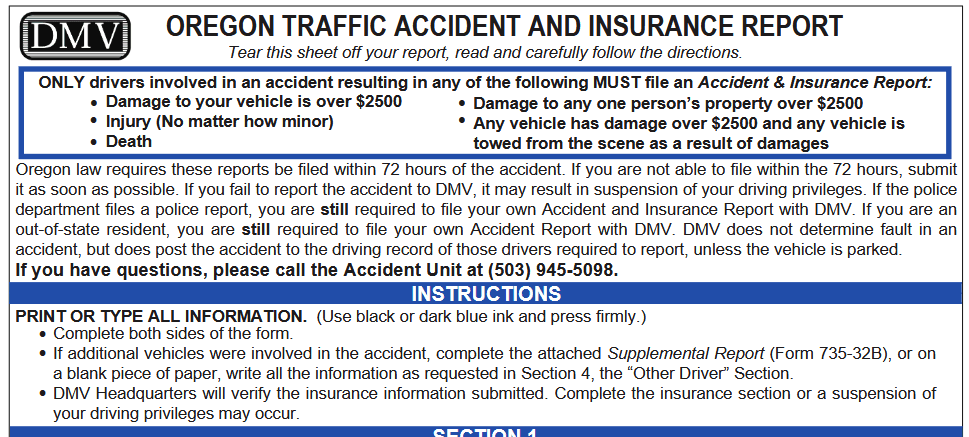

Accident Reporting Requirements (Oregon DMV Rules): In Oregon, you have a legal duty to file an accident report with the DMV in certain situations. If the crash results in any injury or death, or if there is significant property damage, you must submit an Oregon Traffic Accident and Insurance Report to the DMV within 72 hours of the collision oregon.gov oregon.gov. The property damage threshold in Oregon is $2,500:

- If damage to any vehicle is over $2,500 (and any vehicle is towed from the scene due to damage), or damage to your vehicle alone is over $2,500, or damage to any property (other than a vehicle) is over $2,500, you must file a DMV report oregon.gov.

- Also, any injury or a death triggers the reporting requirement, regardless of dollar amountoregon.gov.

This report is a form you fill out (not the same as a police report) and send to Oregon DMV. Failing to file a required accident report can result in a suspension of your driver’s license for up to 5 years or until the report is filed oregon.gov. Essentially, if your crash meets the criteria above, make sure to get the DMV form filed as soon as possible (within 72 hours is the rule). The form will ask for details of the accident, those involved, and your insurance information oregon.gov. Note that even if a police officer files a police report, you still must file the DMV accident report yourself – a police report does not exempt you from this requirement oregon.gov.

When to Involve the Police: Oregon law does not explicitly require police to be called to every accident, but it’s generally recommended to call police if there are injuries, suspected impairment (e.g. a drunk driver), disputes at the scene, or significant damage. For minor fender-benders with no injuries and minimal damage, you might handle it between drivers and later file the DMV report if required. However, having an officer respond can be helpful: the officer will create an official report, document the scene, possibly issue citations, and help exchange information. Additionally, Oregon law does require that for any injury or fatal accident, the drivers must fulfill duties including remaining at the scene and rendering aid – calling 911 satisfies part of this duty to get help for injured persons. In practice, if anyone is hurt or damage is substantial, call the police. For small accidents, you can call the non-emergency police line to see if an officer will be dispatched (some departments only respond to injury crashes). Remember, if another driver flees the scene or is uninsured, having a police report can greatly assist in any insurance or legal claim you pursue.

Oregon Traffic Laws to Keep in Mind: A few other Oregon-specific laws often relevant in accident cases:

- Duty to Stop (“Hit-and-Run” laws): As noted, Oregon requires drivers to stop and exchange info after an accident. Leaving scene of property damage is a Class A misdemeanor; leaving when someone is injured is a felony . Always stop, no matter how minor the collision.

- Right of Way and Crossing Laws: Oregon’s rules on yielding (for example, turning left must yield to oncoming traffic, yielding to pedestrians in crosswalks, etc.) will determine fault in many accidents. For instance, every corner is a crosswalk in Oregon – drivers must stop and remain stopped for a pedestrian in any crosswalk (marked or unmarked) until the pedestrian has cleared your lane and the next lane eugene-or.gov. Violating this is a traffic offense and evidence of negligence if a pedestrian is hit.

- Following Distance and Speed: Basic laws like not following too closely and obeying speed limits are important; a rear-end collision in Oregon is usually presumed the fault of the trailing driver for following too close or not paying attention.

Overall, Oregon’s legal framework aims to ensure that victims can recover from the at-fault party while also carrying personal protection (PIP) for immediate needs. Knowing these laws – fault rules, deadlines, and reporting duties – will help you navigate the aftermath of a crash correctly and lawfully.

3. Insurance & Claims Process in Oregon

Dealing with insurance is often the most complex part after an accident. Oregon has some unique insurance rules (like mandatory PIP coverage) that affect how claims proceed. Here’s a guide through the insurance and claims process:

Mandatory Insurance Coverage in Oregon: Oregon law requires all drivers to carry certain minimum insurance. The minimum liability coverage is 25/50/20 (i.e. $25,000 per person and $50,000 per accident for bodily injury, and $20,000 for property damage) oregon.gov.

In addition:

- Personal Injury Protection (PIP): Minimum of $15,000 in PIP coverage per person oregon.gov.

- Uninsured Motorist (UM) coverage: Minimum of $25,000 per person and $50,000 per accident for bodily injury UM coverage oregon.gov (this automatically includes underinsured coverage in Oregon).

These coverages are required on every Oregon auto policy, so if you have car insurance, you should have at least these amounts. PIP and UM/UIM coverage play a big role in accident claims, as explained below.

Personal Injury Protection (PIP) Benefits: PIP is no-fault coverage that pays your own medical and related expenses after a crash, regardless of who caused the accident. In Oregon, every motor vehicle policy includes PIP. The minimum PIP limits are $15,000 (though you can buy higher). Here’s what PIP typically covers:

- Medical Expenses: PIP will pay reasonable and necessary medical bills for accident injuries, up to at least $15,000, for treatment within 2 years after the accident. This includes hospital bills, surgery, doctor visits, chiropractic care, physical therapy, X-rays, etc., and even ambulance transport. It can also cover some dental care if needed due to the crash. You don’t pay co-pays or deductibles – PIP pays first-dollar until it’s exhausted. (Tip: Keep all receipts and medical records; insurers may require documentation and sometimes an independent medical exam to confirm the treatment is accident-related.)

- Lost Wages: If your injuries cause you to miss work, PIP provides wage loss benefits. In Oregon, PIP pays 70% of your lost wages, up to $3,000 per month, if you are unable to work due to accident injuries. There is usually a 14-day waiting period (you must be disabled for at least 14 consecutive days before wage benefits kick in). You’ll need a doctor’s note certifying you cannot work. This can significantly help if you have to take time off to recover.

- Replacement Services: If you can’t perform essential household tasks (like cleaning, childcare, yardwork) due to your injuries, PIP can pay for substitute services. Oregon PIP typically covers up to $30 per day for having someone help with household tasks you normally did.

- Funeral Expense: In the worst case of a fatal accident, PIP provides a funeral expense benefit, usually up to $5,000.

PIP benefits are usually available to you, relatives in your household, and passengers in your car (each person gets coverage) if injured in the accident. It may also cover you as a pedestrian or bicyclist hit by a car. When an accident happens, you should promptly notify your own insurance company to open a PIP claim so that medical bills can be paid. PIP is there to ensure you get treatment right away without waiting for a legal settlement. Keep in mind, if you later recover damages from the at-fault driver, the at-fault insurer or your own may have subrogation rights to recover some of the PIP payouts – but that’s handled between insurers; your priority is to use PIP for what it’s meant for: immediate support.

Filing an Insurance Claim – Step by Step: After the accident, you will likely deal with multiple insurance claims:

- PIP Claim (Your Insurer): As mentioned, start your PIP claim with your insurer for medical bills and lost wages. This involves filling out a PIP application form and providing info on your doctors, etc. Do this as soon as possible after the accident.

- Property Damage Claim: If your car is damaged, you can file a claim to get it repaired. You have two routes: through the at-fault driver’s liability insurance or through your own collision coverage (if you carry collision insurance). Using the other driver’s insurance costs you no deductible but can take longer if fault is disputed; using your collision is faster (you pay your deductible, then your insurer will subrogate and recover from the other company if possible). Also, if things like a rental car are needed while yours is in the shop, that might be covered (the at-fault’s insurer should pay for a rental car for a reasonable time; your policy might cover rental if you have that optional coverage).

- Bodily Injury Liability Claim: This is the claim against the at-fault driver’s insurance for your injuries, pain and suffering, lost wages beyond PIP, etc. Typically, after you’re medically stable or have a sense of your total damages, you (or your attorney) will send a demand letter to the at-fault driver’s insurance company. The demand outlines the accident details, why their insured was at fault, and documents your injuries and losses (medical bills, lost income, etc.), and it proposes a lump sum as compensation.

- Uninsured/Underinsured Motorist (UM/UIM) Claim: If the at-fault driver has no insurance or not enough insurance, your own policy’s UM/UIM coverage comes into play. In an uninsured scenario, your insurer essentially steps into the shoes of the at-fault party’s insurer and should pay your injury damages (up to the UM limits). In an underinsured case, if the at-fault driver’s liability limits are too low to cover your losses, your UIM coverage can pay the excess (up to your UIM limits). Example: The other driver has minimum $25k coverage but your damages are $50k; they pay $25k, then your UIM can cover the remaining $25k (if you have at least that in UIM). We discuss UM/UIM more below, but remember to notify your insurer if you suspect the other driver is uninsured or underinsured, to preserve your UM/UIM claim.

Dealing with Insurance Adjusters – Do’s and Don’ts: Soon after the accident, you will likely get calls from insurance adjusters – both from your own company and the other driver’s insurer. It’s important to handle these communications wisely:

- Notify Your Insurer, But Be Cautious with the Other Side: You should report the accident to your own insurer promptly (most policies require “prompt” or within a certain number of days notice). When it comes to the other driver’s insurance (the liability insurer who would pay your claim), you are not required to give them a detailed statement immediately. It’s usually best to avoid giving a recorded statement to the at-fault driver’s insurer without consulting an attorney. Adjusters may ask you to record your account of the accident – this can be tricky because they may later try to use inconsistencies or innocent remarks against you. It’s often okay to provide basic facts (date, location, vehicles involved) but politely decline any recorded interview until you’ve had legal advice.

- Don’t Admit Fault or Downplay Injuries: In conversations with any insurance (even your own), don’t say things like “It was partly my fault” or “I’m not really hurt.” Stick to the facts of what happened. If you’re not sure, don’t speculate. For example, if asked “How are you feeling?” it’s safer to say “I’m seeking treatment and following doctor’s advice” rather than “I’m fine” (which could be used later to argue you weren’t injured).

- Beware Quick Settlement Offers: It’s common for an insurance company (often the at-fault driver’s insurer) to offer a fast, low settlement early on – sometimes even within days of the crash – especially if they know you’re injured. They might offer a few thousand dollars and ask you to sign a release. Be very careful here: accepting a quick settlement and signing a release will end your claim, and if you later discover your injuries are worse (e.g. needing surgery or long-term therapy), you cannot go back for more money. Never settle a injury claim until you know the full extent of your injuries and costs.

- Adjuster Tactics: Insurance adjusters are trained professionals whose job is to protect the insurance company’s bottom line. They often employ tactics to minimize payouts. Some common tactics include:

- Friendly Chit-Chat: They may sound sympathetic and friendly to earn your trust, then get you to say things that hurt your claim.

- Shifting Blame: Even in clear-cut cases, an adjuster might suggest you were partly at fault – for instance, saying you were driving too fast or not paying attention – to reduce what they have to pay. Remember Oregon’s comparative fault rule: if they can push 51% or more fault onto you, they pay nothing. Expect them to look for ways to attribute some blame to you.

- Requesting Excessive Info: They may ask for broad medical record authorizations to fish through your entire health history (trying to pin your injuries on a prior condition rather than the crash). Only release relevant records.

- Delaying: Sometimes insurers drag their feet knowing bills will pile up, hoping you’ll accept a lower offer out of desperation. Stay patient and keep records of all communications.

- Saying You Don’t Need a Lawyer: Adjusters might suggest hiring a lawyer will just cost you money or slow things down. In truth, insurance companies handle countless claims and have experts on their side – without a lawyer, you may have little leverage.

- Keep Documentation: Document every interaction with insurers. Keep a claim diary noting dates of calls, who you spoke to, and a summary of what was said. Save all letters or emails. This can be evidence if there’s a dispute or if the insurer violates any claims-handling regulations.

Uninsured and Underinsured Motorist Coverage: Oregon requires policies to include Uninsured Motorist (UM) coverage (which also encompasses underinsured coverage) to protect you if you’re hit by someone with no insurance or not enough insurance. Here’s how it works:

- Uninsured Motorist (UM): If an at-fault driver has no liability insurance, your UM coverage will pay for your medical bills, lost wages, and pain and suffering up to your policy limits (minimum $25k per person in Oregon, though many drivers carry higher). This applies also in a hit-and-run if the at-fault driver flees and is not found – that’s treated as an “uninsured” scenario. You generally must report a hit-and-run promptly and cooperate with police for your UM claim to be valid (to prevent fraud).

- Underinsured Motorist (UIM): If the at-fault driver has insurance but not enough to cover all your damages, your UIM coverage can make up the difference. For example, say your total damages are $100,000 and the at-fault driver only has $50,000 liability coverage. Once you collect that $50k (policy limit) from them, you could claim up to $50k from your UIM (if your UIM limits are at least $100k) to cover the rest. Oregon’s law essentially matches your UM/UIM limits to your liability limits by default, so most Oregonians have equal coverage – if you carry higher liability limits, your UM/UIM should be the same, unless you specifically reduced it. This means your own insurance policy is your safety net in a serious accident caused by someone with minimal insurance.

Why is UM/UIM so important? Unfortunately, a significant number of drivers on the road don’t have insurance or carry only the bare minimum. In Oregon, it’s estimated around 10–13% of drivers are uninsured (about 1 in 10). Many more carry only the minimum $25k policy which may not fully cover a serious injury. UM/UIM coverage makes sure you’re not left holding the bag if you’re hit by an uninsured or underinsured driver. It steps in to compensate you just as if the at-fault had adequate insurance. Keep in mind, UM/UIM claims are made against your own insurer, and these can sometimes become adversarial (since your insurer then is essentially acting as the liability insurer). Often, disputes in UM/UIM claims (like disagreement on the value of your injury claim) are resolved by arbitration rather than a lawsuit, as many policies have arbitration clauses for UM/UIM. Nonetheless, treat a UM/UIM claim seriously – you may even need an attorney’s help to negotiate with your insurer if they undervalue your claim.

Filing and Negotiating an Insurance Claim: Once you’ve recovered sufficiently or reached a point of maximum medical improvement, and you have collected all the documentation (medical records, bills, proof of lost income, etc.), you or your attorney will present a demand to the at-fault party’s insurance. Here are steps in the claims and negotiation process:

- Notify & Open Claim: Right after the crash, notify both your insurer (for PIP/UM) and the other party’s insurer that an accident occurred and you intend to file a claim. This gets a claim number assigned.

- Investigation: Expect both insurers to investigate. They may take statements, review the police report, inspect vehicles, etc. Cooperate within reason, but remember your rights (as noted above about statements).

- Document Your Damages: Keep records of all expenses related to the accident – medical bills, prescription receipts, mileage to doctors, property damage estimates, rental car invoices, etc. Also document pain and suffering: keep a journal of how injuries impact your daily life, missed events, and so on.

- Submit a Demand Package: This is typically a letter outlining who was at fault and why (citing any supporting evidence or laws), and detailing all of your damages: medical costs, lost wages, and an amount for pain, suffering, and any permanent effects. Attach copies of medical records, bills, wage loss verifications, and photos (injuries or damage) as evidence. You will demand a dollar amount (usually higher than what you’d actually settle for) to start negotiations.

- Negotiations: The insurance adjuster will review and usually respond with a lower offer. Negotiation then goes back and forth. They might point to some weaknesses (or allege you were partly at fault, or that some treatment was excessive) to justify a low offer. You (or your lawyer) counter these arguments with facts – for example, clarifying the severity of injuries or that you followed all doctor’s orders. It may take several rounds to approach a fair settlement.

- Settlement: If both sides agree, the insurer will issue a settlement agreement and release form. Do not sign a release until you are sure the settlement covers everything, because once signed, your claim is closed permanently. Upon signing, the insurer will cut a check (often sent to you and your attorney if you have one, to handle any medical liens) and that’s the end. Most car accident claims in Oregon are resolved by settlement without a lawsuit, but you should be prepared to file a lawsuit if needed (see next section).

- If No Agreement: If negotiations stall or the insurer denies the claim or offers far too little, then your recourse is to proceed with legal action (or, in a UM claim, possibly arbitration). A lawsuit may prompt a more reasonable offer once the insurer sees you’re serious, or it will lead to a trial where a jury decides.

Common Mistakes to Avoid in the Claims Process:

- Delaying Medical Treatment: Gaps or delays in treatment give the insurer ammo to say you weren’t really hurt or that you failed to mitigate your damages. Follow up promptly and consistently with doctors.

- Not Following Doctor’s Orders: If you skip recommended therapy or ignore medical advice, the insurer can argue your injuries are your own fault for not treating them properly.

- Posting on Social Media: Be very careful about social media. Insurers do check claimants’ Facebook/Instagram. A seemingly innocent photo of you hiking or at a party, while claiming injury, can be twisted. It’s best to avoid posting about your injuries or activities at all until the claim is resolved.

- Settling Too Early: As mentioned, don’t let the lure of quick cash make you settle before you know your prognosis. Once you sign off, you can’t ask for more if complications arise.

- Assuming the Adjuster is on Your Side: Always remember, no matter how friendly, the adjuster’s loyalty is to their employer – the insurance company – not to you. Their goal is often to settle the claim for as little as possible (or deny it if they can find a valid reason).

Navigating insurance claims can feel like a minefield, but being informed will help tremendously. If at any point it becomes overwhelming or the stakes (injuries, money) are high, don’t hesitate to consult a personal injury attorney – they can take over the dealings with insurance so you don’t have to worry about saying the wrong thing or getting low-balled (more on when to hire a lawyer in the next section).

4. When & Why to Hire a Lawyer

Not every fender-bender requires a lawyer, but in many accident cases, especially those involving injuries, having an experienced Oregon personal injury attorney on your side can be a game-changer. Here we outline situations where legal representation is critical, how a lawyer can increase your compensation and handle tricky insurers, and how contingency fees work so you can access a lawyer with no upfront cost.

When You Should Strongly Consider a Lawyer:

- Serious Injuries or High Medical Bills: If you or a loved one suffered severe injuries (e.g. broken bones, surgery, hospitalization, long-term complications, or permanent impairment), you absolutely should get a lawyer. High medical costs and significant pain and suffering mean a larger claim – and insurance companies fight harder against big claims. A lawyer will accurately value your case (including future medical needs and lost earning capacity) and push for full compensation.

- Disputed Liability (Fault is Unclear or Contested): If there is any argument about who caused the accident – for example, conflicting stories, lack of witnesses, or multiple vehicles involved – an attorney can conduct a proper investigation. They can gather evidence such as traffic camera footage, hire accident reconstruction experts, and interview witnesses under oath to prove liability. When fault is in dispute, insurers are very likely to deny or reduce the claim; legal help is crucial to build your case.

- Insurance Company Denies or Undervalues Your Claim: If you hit a wall with the insurance company – they outright deny your claim or offer a token low amount despite clear liability – an attorney’s intervention can often turn things around. Sometimes even just retaining a lawyer and having them communicate with the insurer signals to the company that you mean business. Insurers have armies of adjusters and lawyers; without your own lawyer, you generally have no leverage. If your claim is denied, a lawyer can file a lawsuit and use the power of subpoena and litigation to get the evidence needed.

- Complex Situations: Some accidents have complexities that definitely call for legal expertise. For example:

- Accidents with Commercial Trucks (big rigs) or corporate vehicles – these involve corporate defendants, multiple insurance layers, and federal regulations.

- Accidents in a Rideshare (Uber/Lyft) – these involve multi-tiered insurance (personal and corporate policies) and notification requirements.

- Pedestrian or Bicycle accidents where serious injuries occur and there might be arguments of pedestrian/bicyclist fault.

- Government vehicle accidents (like being hit by a city bus or police car) – special claim procedures and shorter timelines apply (Oregon Tort Claims Act notice).

- Hit-and-run accidents – you may need to rely on UM coverage and prove the hit-and-run occurred.

- Permanent Disability or Wrongful Death: If the accident caused life-altering injuries (brain injury, paralysis, etc.) or the death of a family member, these are high-stakes cases. A lawyer will help pursue not just compensatory damages but possibly future damages, long-term care costs, and in some cases punitive damages. Also, wrongful death claims have specific legal rules and damage categories (for example, Oregon law allows certain family members to recover). You’ll want an attorney to handle such a delicate and significant matter.

How a Lawyer Can Help (and Boost Your Compensation): A good personal injury attorney does far more than file paperwork. They bring expertise and advocacy that often results in higher settlements and verdicts for clients. In fact, research shows that injured parties who hire lawyers generally receive substantially higher compensation than those who go it alone. Here’s what an attorney will do for you:

- Handle All Communication: Once you have a lawyer, they will take over communications with insurance companies. This means no more harassing calls from adjusters – and no risk of you saying something that harms your case. Insurers must go through your attorney, which often leads to more professional and serious dialogue.

- Investigate and Gather Evidence: Law firms have resources to investigate the crash thoroughly. They can obtain accident reports, scene photographs, surveillance videos, 911 call recordings, and hire investigators to locate witnesses or gather additional evidence. In complex cases, they might bring in accident reconstruction experts or engineers. This level of investigation can uncover crucial evidence of fault that you might not access on your own.

- Properly Value Your Claim: One of the toughest parts for a layperson is knowing what your injury claim is truly worth. Attorneys have experience with cases like yours and know how to calculate all forms of damages – not just medical bills, but lost future earnings if you can’t return to the same job, the cost of any vocational retraining, compensation for pain, suffering, and mental anguish, and any loss of quality of life (for example, if you can no longer enjoy hobbies). They also can advise on likely jury awards in your area. This knowledge allows them to counter lowball offers with solid reasoning and demand fair value.

- Negotiate with Adjusters (who respect attorneys): Insurance adjusters are skilled negotiators working for the company. When you have an attorney, the playing field levels. Attorneys know the tactics adjusters use and won’t be intimidated or tricked. They will present your case in the most compelling way, backed by evidence and legal arguments. If the insurer still won’t budge, a lawyer can ramp up pressure by preparing to file a lawsuit – the threat of litigation alone often motivates a better offer.

- Handle Legal Procedures & Paperwork: If a lawsuit is necessary, an attorney will draft the complaint, file it within deadlines, handle court motions, and navigate the litigation process (discovery, depositions, etc.) efficiently. Legal procedures are complex and missing a filing or doing it incorrectly can derail a case – so having a professional ensures your case proceeds correctly.

- Advocate in Alternative Dispute Resolution: Many cases go to mediation or arbitration. An attorney representing you in mediation will fight for the best settlement and advise you on whether to accept or continue to trial. In arbitration (which might be required for UM claims or smaller cases in Oregon’s courts), the lawyer will present your case to the arbitrator just like in a trial.

- Trial Representation: If your case goes all the way to trial, you absolutely need an attorney. They will select a jury, make opening statements, cross-examine witnesses (including any experts the defense brings), and make persuasive arguments under the rules of evidence. Trial is a complex art – a seasoned trial lawyer can make a significant difference in the outcome. Insurance companies know which lawyers are willing and able to go to trial; if your lawyer has a strong reputation, the insurer may offer more to avoid facing them in court.

- Higher Settlements: Ultimately, all of the above often results in higher payouts. Statistics and industry studies have indicated that even after accounting for attorney fees, injured people often net more with an attorney because the overall settlement is much larger. Insurers’ own data suggest claims with legal representation pay out more. This is because attorneys uncover all available insurance (sometimes there are multiple policies), maximize the claim value, and are willing to fight longer and harder.

In short, a lawyer is your champion who protects you from the tricks of insurance companies and aims to get you every dollar you deserve. They also reduce your stress significantly by handling the heavy lifting.

Understanding Contingency Fees (No Upfront Costs): One barrier people fear is cost – “Can I afford a lawyer?” The good news is almost all Oregon car accident and personal injury lawyers work on a contingency fee basis. A contingency fee means you pay nothing upfront or out-of-pocket. The attorney only gets paid if they win or settle your case, and their fee is a percentage of the recovery. Typical contingency fees in Oregon range from 33% (one-third) to 40% of the total settlement or award. A common arrangement is one-third if settled before a lawsuit, and maybe 40% if it goes into litigation or trial (reflecting the additional work). This will be specified in a written fee agreement you sign when hiring them.

For example, if your case settles for $90,000, a 33.3% fee would be $30,000 to the attorney. If the case is lost, you owe the attorney no fee at all. This system aligns the lawyer’s interests with yours – they are motivated to maximize your compensation. Keep in mind, contingency fees usually do not include case expenses – costs for things like obtaining medical records, court filing fees, expert witness fees, deposition transcripts, etc. Many firms will front these costs during the case, and then they are reimbursed from the settlement (often they come out of the gross settlement before the fee percentage is calculated, or however the contract specifies). Always discuss with your attorney how costs are handled. But importantly, you generally do not pay anything upfront – even consultations are almost always free.

Oregon has some regulations on contingency fees (for instance, they must be in writing and you have a right to cancel shortly after signing if you change your mind oregon.public.law), but in practice the standard percentage system is as described. If you recover nothing, you typically pay nothing (though confirm if you’d owe any advanced costs – many lawyers will waive those if the case is lost).

Bottom Line: If you have anything more than a very minor injury, at least talk to a lawyer for a free consultation. Most Oregon personal injury attorneys will review your situation at no charge. They can tell you if you even need a lawyer or if the case is straightforward enough to handle on your own (for example, small claims). There’s no harm in getting advice. And if you do hire one, you get peace of mind that a professional is fighting for you, allowing you to focus on recovery. As one Oregon firm notes, insurance companies handle hundreds of claims and are experts – without an attorney, you as the victim have little leverage. Having legal representation evens the playing field and often results in higher settlements and verdicts for you, even after the attorney’s fee.

5. Filing a Lawsuit & the Legal Process

Sometimes, despite your best efforts to resolve an accident claim through insurance, you can’t reach a fair settlement. Maybe the insurance company denies liability or offers an amount far below your damages, or perhaps the statute of limitations is approaching with no resolution. In these cases, filing a lawsuit is the next step. Here’s an overview of what happens if you enter the legal process for a personal injury case in Oregon, including what to do if a claim is denied, the stages of a lawsuit, and how mediation/arbitration/trials work.

When an Insurance Claim is Denied or Unfair: If the at-fault party’s insurer denies your claim (for example, claiming their driver wasn’t actually at fault or that your injuries aren’t related) or if they refuse to offer a reasonable settlement, you should consider filing a lawsuit. Often, the threat of a lawsuit or actually filing one can motivate an insurer to rethink their position. Insurance companies must consider the cost of litigation and the risk a jury could award more than what you were asking. Filing suit shows you are serious and willing to let a court decide. Additionally, some drivers may not have insurance or the insurance might not cover the situation (e.g., if the driver was excluded from the policy). In that case, suing the at-fault driver personally might be needed (though collectability of any judgment becomes an issue).

Filing a Lawsuit (Complaint): A personal injury lawsuit from a car accident is a civil action usually filed in state Circuit Court (or sometimes in federal court if parties are from different states and the amount is big, but typically state court for local accidents). Your attorney will draft a Complaint – a legal document that outlines the facts, alleges how the other party was negligent (e.g., violated traffic laws), and describes your damages. The complaint is filed with the court and then “served” on the defendant (the at-fault driver, and sometimes also the owner of the vehicle if different, or employer if it was a work vehicle). In Oregon, you generally have to serve the lawsuit within 60 days of filing the complaint. Once served, the defendant (through their insurance-provided attorney) must file an Answer to admit or deny the allegations.

The Discovery Phase: After the initial pleadings (Complaint and Answer), the case enters discovery, which is essentially an information-gathering stage where both sides exchange evidence and learn about the other’s case. Discovery can include:

- Interrogatories: Written questions that each side sends to the other to be answered under oath.

- Document Requests: Each party can request documents relevant to the case (medical records, repair bills, pay stubs for wage loss, insurance policies, cell phone records if distraction is at issue, etc.).

- Depositions: These are out-of-court sworn interviews where attorneys question the other side (and witnesses) in person, with a court reporter transcribing. You might be deposed by the defense attorney – they’ll ask about the accident, your injuries, medical history, and so on. Your attorney can depose the defendant driver (for example, to pin down their story or possibly get admissions of fault) and other witnesses like doctors (expert depositions).

- Medical Examinations: The defense has a right to have you examined by a doctor of their choosing (often called an IME – Independent Medical Exam, though it’s really a defense exam) to get their own assessment of your injuries.

Discovery is a critical period that can last many months. Both sides assess the strength of the evidence. Often, settlement talks heat up after key discovery (for instance, after depositions, each side has a better idea how a jury might view the case).

Mediation and Arbitration: Before going to trial, most courts and attorneys will explore settlement through mediation. Mediation is an informal settlement conference facilitated by a neutral third-party (the mediator). In Oregon, mediation is voluntary but highly encouraged; some counties even require a mediation attempt before trial. The mediator doesn’t force a decision but tries to help both sides reach a compromise. It’s confidential – if it fails, nothing discussed can be used in trial. Many cases settle at mediation when both sides (with the mediator’s help) get a realistic view of the case.

Arbitration is another form of alternative dispute resolution. Oregon has a system of mandatory arbitration for smaller civil cases – if the claim is under a certain dollar amount (commonly $50,000 or less in many counties), the case may be referred to arbitration by rule osbar.org. In court-annexed arbitration, an arbitrator (often an experienced attorney) will conduct a hearing (less formal than a trial, but evidence is presented, and witnesses testify under oath) and then issue an award. Either party who doesn’t like the arbitration result can usually request a “trial de novo” (new trial) within a certain time, essentially nullifying the arbitration – but there may be cost penalties if they don’t do better in the trial than the arbitration award. Arbitration is also standard for UM/UIM claims due to insurance contract terms – those are private arbitrations according to your policy, but the idea is similar: a binding decision by a neutral. Arbitration is generally faster and less costly than a trial, but you waive a jury. Many cases resolve here if both sides accept the arbitrator’s award or settle during the process.

Going to Trial: If negotiation, mediation, or arbitration don’t resolve the case, it proceeds to a jury trial (or bench trial if both sides agree to have a judge decide). In an Oregon car accident jury trial, jurors (typically 12 jurors in civil cases, with 3/4 needed to agree for a verdict in Oregon) will hear the evidence and decide two main things: liability (who was at fault, and if comparative fault is argued, each party’s percentage of fault) and damages (the amount of money that fairly compensates the plaintiff).

Here’s what happens in a trial:

- Jury Selection: The attorneys and judge question a pool of potential jurors (voir dire) to weed out bias. For example, jurors who work in insurance might be questioned for bias, or someone who strongly dislikes lawsuits might be excused.

- Opening Statements: Each side presents an overview of their case – your attorney will explain how the defendant was negligent and how it hurt you; the defense may downplay your injuries or shift blame.

- Plaintiff’s Case: Your side presents its case first. Witnesses are called. You might testify telling your story of the accident and how it affected you. Perhaps eyewitnesses testify the other driver ran a red light, or an accident reconstruction expert explains the crash dynamics. Doctors or medical experts discuss your injuries and future needs. The defense can cross-examine each witness.

- Defense’s Case: The defense then presents witnesses. The at-fault driver may testify (often to give their version or to say it wasn’t as bad, etc.). They might have medical experts who examined you testify that your injuries were pre-existing or not as severe as claimed. They could call other experts (like to dispute your lost wage calculations, etc.). Your lawyer cross-examines their witnesses.

- Closing Arguments: Both sides sum up the evidence and argue why the jury should side with them. Your lawyer will likely emphasize the defendant’s fault and the extent of your losses, and ask the jury to return a verdict for a specific amount. Defense will argue maybe that you had some fault, or that your injuries are exaggerated, etc., and suggest a low damages number or none at all.

- Jury Deliberation: The jury deliberates in private. They will first decide if the defendant was negligent and if that negligence caused your injuries. If there was a claim of your comparative fault, they assign percentages. Then they decide the money damages. Oregon law will have the judge reduce the verdict by any percentage of fault they assigned to you (per the comparative negligence rule).

- Verdict: The jury returns a verdict. For example, they might say defendant was negligent, plaintiff had 0% fault, and damages are $100,000. Or they might split fault 20/80 and award $50,000 damages (which the court would adjust to $40,000 if you had 20% fault). If the verdict is in your favor, the defendant’s insurance will pay it (up to policy limits – if verdict exceeds their insurance, complicated issues can arise about collecting the rest, but large verdicts usually happen when insurance was ample or multiple defendants). If the jury finds for the defense (no liability), you get nothing (and typically you can discuss with your attorney about any appeal possibilities if there were legal errors).

Trials can be unpredictable. That’s why most cases settle before reaching a verdict. But knowing that you are prepared to go to trial gives you strength in bargaining. Many attorneys prepare every case as if it will go to trial, which often leads to better settlements because the other side senses your readiness.

What if You Win – or Lose – at Trial: If you win, the judgment is entered and the defendant/insurer will pay, usually within a few weeks (or if an appeal is filed by the defense, payment might wait until after appeal). If you lose, you generally cannot recover anything (and you would still owe any medical bills that were waiting on the outcome). Oregon follows the “American Rule” for attorney fees – each side pays their own lawyer, except in some specific situations. One such situation: Oregon has ORS 20.080, which can allow attorney fees for the plaintiff if the case was for $10,000 or less and you made a proper demand and then won more than the insurance ever offered – this is to encourage settlements in small cases. In bigger cases, each side bears their own fees, win or lose, unless a statute or contract says otherwise. Costs (filing fees, deposition costs) can sometimes be recovered by the winning party, at the court’s discretion.

Timeline: The whole process from filing a lawsuit to trial can take a long time – often 1 to 2 years, sometimes more, depending on the court’s schedule and complexity. Be prepared for a marathon, not a sprint, when litigation begins. However, keep in mind settlement can occur at any point – even the day before trial or during trial. In fact, it’s not uncommon for cases to settle on the courthouse steps when both sides do a final risk assessment.

In summary, filing a lawsuit is a powerful tool to get justice if the insurance process fails to deliver a fair result. It triggers a structured process where evidence is brought to light. Most cases will resolve either through negotiation spurred by the lawsuit or via mediation/arbitration. Only a small percentage go all the way to verdict. But by being willing to litigate, you ensure that you won’t be forced to take an inadequate offer. If you do need to sue, having a capable Oregon personal injury lawyer is essential to guide you through this legal maze and fight for your rights in court.

6. Special Considerations for Different Types of Accidents

All motor vehicle accidents are not the same. Specific types of accidents – like those involving commercial trucks, motorcycles, bicycles, pedestrians, or rideshare vehicles – come with unique issues and laws. In this section, we highlight special considerations for different types of accidents that are common in Oregon:

Truck Accidents (Commercial 18-Wheeler Crashes)

Accidents involving large commercial trucks (semis, tractor-trailers) are often devastating due to the sheer size and weight of trucks. They also bring in additional legal factors:

- Higher Stakes and Insurance: Trucking companies and truck drivers are required to carry much higher liability insurance limits than regular cars because of the potential damage they can causer. It’s not unusual for a trucking policy to have $1 million or more in coverage. While this means more funds are available for victims, it also means the trucking company’s insurer will mount an aggressive defense to avoid a big payout. They often dispatch investigators to the scene immediately to gather evidence in their favor.

- Federal and State Regulations: Commercial trucks and drivers are subject to extensive regulations (FMCSA rules). For example, Hours-of-Service rules limit how long a trucker can drive without rest – to prevent fatigued driving. If a truck driver violated these rules (say, drove longer than allowed and fell asleep at the wheel), it can strongly establish negligence. Other regulations cover truck maintenance, cargo loading limits, alcohol/drug testing, and driver qualifications. An attorney experienced in truck accidents will look at logbooks, black box data (many trucks have electronic logging devices and event data recorders), and maintenance records to find regulatory violations. A violation (like defective brakes or an overloaded trailer) can explain the cause of a crash and lead to the trucking company being held liable.

- Multiple Potential Defendants: In a truck accident, it’s not just the driver who may be at fault. The trucking company (carrier) that employs the driver is usually liable under respondeat superior (employer responsibility for employee). If the truck driver was an independent contractor, the legal situation can be nuanced, but often the trucking company can still be liable if they controlled the work or if negligence is found in their hiring/training practices. Additionally, other parties could share blame: the freight loader (if improper loading caused a shift/spill), a maintenance contractor (if negligent repairs led to failure), or the truck manufacturer (if a defect caused the crash). These cases can require thorough investigation to identify all causes. For example, if a tire blew out, was it due to poor maintenance by the company or a defect in the tire? Including all responsible parties ensures you can recover full compensation.

- Severity of Injuries: Impacts with trucks often result in severe or catastrophic injuries (traumatic brain injuries, spinal cord injuries, multiple fractures) or fatalities. The damages in truck cases tend to be very high. It’s crucial to account for long-term medical care, rehabilitation, and lost earning capacity if the victim is permanently disabled. Oregon juries have given substantial awards in egregious truck accident cases, especially if there’s evidence of gross negligence (like a drunk truck driver or knowingly ignoring safety regulations).

- Common Causes: Common causes of truck accidents include truck driver fatigue, speeding, distracted driving, or impairment; and sometimes equipment failure (brake failure, tire blowouts) or weather-related issues. One large federal study found the top critical events leading to truck crashes were trucks running out of their travel lane (e.g., off the road or into another lane) – about 32% of crashes studied– loss of control (from speeding, cargo shift, etc.) ~29%, and rear-ending another vehicle ~22%. Knowing these common scenarios helps in investigating – e.g., if a truck drifted off the road, was the driver asleep or distracted?

- Trucking Industry Defense Tactics: Be aware that trucking companies often have “rapid response” teams. They might get to the scene to take photos, talk to police, and sometimes attempt to minimize their driver’s fault. Important evidence such as driver logbooks or electronic data might go missing if not preserved. This is why getting a lawyer quickly after a serious truck crash is important – they can send spoliation letters to preserve evidence and even file for a court order to secure the truck’s data.

If you’re involved in a truck accident, treat it as a very serious legal situation. The scene can be chaotic, but if possible, gather the truck’s company name, USDOT number (usually on the cab), and the license plate. Report the crash to police without delay (they will likely do a detailed report given the severity). These cases are complex – often a personal injury attorney with experience in trucking litigation is almost necessary to navigate the web of regulations and company relationships. Trucking accidents in Oregon often involve both Oregon law and federal trucking regulations, making them a specialty area in personal injury law.

Motorcycle & Bicycle Accidents

Motorcyclists and bicyclists are vulnerable road users who face unique risks on Oregon’s roads. When a crash happens, they often suffer serious injuries since they lack the protection of an enclosed vehicle. Here are key points for these types of accidents:

- Helmet Laws: Oregon has strict helmet laws for motorcyclists. All motorcycle operators and passengers must wear a DOT-compliant helmet by law at all times when the bike is in operation. Failure to wear a helmet not only can result in a citation, but if a rider is injured and wasn’t wearing a helmet, it could complicate a claim. The defense might argue the injuries (especially head injuries) are partly the rider’s fault for not wearing a helmet, potentially invoking comparative negligence. For bicyclists, Oregon law requires helmets for riders under 16 years old bikelaw.com. Adults 16 and over are not legally required to wear a bicycle helmet (though it’s strongly advised for safety). If an adult cyclist is hit by a car and wasn’t wearing a helmet, the driver cannot use that as evidence of negligence in Oregon because there’s no legal requirement – however, a jury might informally consider it, and some defense might attempt to argue the injuries could have been less with a helmet. But legally, because not wearing a bicycle helmet as an adult isn’t a violation, it shouldn’t reduce the cyclist’s claim. Still, wearing a helmet is the best practice for safety and claims alike.

- Right-of-Way and Traffic Laws: Motorcycles and bicycles have the same rights to the road as cars, but many crashes occur because drivers fail to yield to them. Common motorcycle accidents include when a car turns left in front of an oncoming motorcycle (the driver often “didn’t see the motorcycle”), or a car changes lanes into a motorcycle. For bicycles, a frequent scenario is a right-hook – a car turning right at an intersection or into a driveway cuts off a cyclist going straight in a bike lane. Oregon law (ORS 811.050) requires drivers to yield to bicycles in bike lanes. Also, drivers must yield to an oncoming bicycle just like a car when turning left. Pedal cyclists also have rules: they should obey traffic signals and stop signs, and at night must have lights/reflectors. If a cyclist was violating a law (say, running a red light) and a crash happens, that can reduce or bar their recovery under comparative negligence.

- Motorcycle Specific Factors: Motorcycles are faster and smaller, so accidents often involve issues of visibility and speed. There is sometimes a bias among jurors or police assuming a motorcyclist was speeding or riding recklessly. It’s important to counteract bias with evidence (skid marks, speed calculations, witness statements). Also, motorcycle accidents frequently result in severe injuries like road rash, broken limbs, or head injuries – claims often involve substantial pain and suffering and sometimes future disability. Insurance adjusters might try to argue that as a motorcyclist you “assumed the risk” by riding – that’s not a valid legal defense if the driver was negligent, but it reflects prejudice that might need to be overcome.

- Bicycle Specific Factors: In urban areas like Portland (known for being bike-friendly), there are many cyclists. Oregon law recognizes “every corner is a crosswalk” (for peds) and similarly recognizes bikes as legitimate users of the road. A special Oregon law concept is the “Idaho Stop” (actually, Oregon has not fully adopted it – as of 2020 Oregon allows cyclists to treat stop signs as yield signs in certain circumstances, but must still stop for red lights). If a cyclist was slightly outside a crosswalk or crossing mid-block, drivers might claim the cyclist was at fault. Comparative negligence will weigh each party’s actions. Oregon has a statute (ORS 814.480) that prohibits bicyclists from suddenly leaving a curb into traffic such that an immediate hazard is created – this is to prevent dart-out scenarios. Such factors could come up in a bike accident claim. Additionally, dooring incidents (a parked car driver opens a door into a cyclist) are the driver’s fault under Oregon law (illegal to open a door without checking, ORS 811.490).

- Insurance for Cyclists and Motorcyclists: One challenge: bicyclists typically don’t have an “insurance” dedicated to cycling. If a cyclist is hit by a car, the car’s auto insurance should cover the cyclist’s injuries (liability/PIP). If it’s a hit-and-run or the driver has no insurance, the cyclist’s own auto policy’s UM coverage can cover them even though they were on a bike – as long as they personally have auto insurance, it usually covers them if struck as a pedestrian or cyclist. Motorcyclists have their own motorcycle insurance (required similar to auto insurance). Motorcyclists in Oregon are not required to carry PIP on their motorcycle policies (Oregon’s PIP mandate is only for “motor vehicles” but specifically excludes motorcycles). So injured motorcyclists might not have PIP to cover immediate medical bills, which makes pursuing the at-fault driver’s insurance or health insurance important. Also, motorcyclists can (and absolutely should) carry UM/UIM coverage on their bike policy – because if hit by an uninsured driver, they’ll need it.

- Bias and Jury Perception: Be aware that personal bias can come into play. A law-abiding motorcyclist or bicyclist might still face skepticism (“motorcycles are dangerous,” or “bicyclists don’t follow rules”). In a claim or trial, it’s important to establish that you were a safe rider. Wear proper gear (helmet, reflective gear) – not only for safety, but it shows responsibility. If you have a motorcycle endorsement and training (like completion of Team Oregon safety courses), that can demonstrate your competence.

In any motorcycle or bicycle accident case, investigation is key. Skid marks, bike damage, helmet damage, all can tell a story. Don’t dispose of your damaged helmet or gear – they can be evidence of impact and injury forces. And given the higher injury severity, consult a lawyer early; they can help preserve evidence and handle insurance issues (like coordinating your health insurance to pay bills if no PIP, then dealing with reimbursement later).

Pedestrian Accidents

Pedestrian accidents often result in severe injuries, since a person on foot has zero protection when struck by a moving vehicle. In Oregon, pedestrian rights are strongly protected by law, but liability can sometimes be contested if jaywalking or other factors are in play. Key considerations:

- Crosswalk Laws: Oregon’s pedestrian right-of-way laws are very favorable to pedestrians. Drivers must stop and remain stopped for pedestrians in a crosswalk (marked or unmarked) when the pedestrian is in the driver’s lane or the next lane eugene-or.govoregonsaferoutes.org. Practically, the rule is often described as: if a pedestrian is anywhere in your half of the roadway, or within one lane of your half, you must stop. And you can’t just do a rolling yield; you must remain stopped until the pedestrian clears your half of the road. Every intersection, by definition in Oregon law, has a crosswalk whether painted or not. Additionally, if one car is stopped at a crosswalk, another car coming from behind cannot overtake and go around – they must assume a pedestrian may be crossing. These laws mean in many pedestrian accidents, the driver will be found at fault, especially if it occurred in a crosswalk or at an intersection.

- Mid-block Crossing and “Jaywalking”: If a pedestrian crosses in the middle of a block, not at a crosswalk, Oregon law might consider them outside of right-of-way protection at that moment. That doesn’t mean a driver can simply hit them without fault – drivers still have a general duty to avoid collisions if possible. However, a pedestrian who crosses against a signal or darts into traffic can be considered negligent too. In such cases, comparative negligence applies: a jury might assign a percentage of fault to the pedestrian for not using a crosswalk or crossing when it wasn’t safe. If a pedestrian suddenly runs out and a car had virtually no time to react, the driver may not be considered negligent at all. Each situation is fact-specific. But even if you as a pedestrian were partially at fault, you might still recover a portion of damages as long as your fault wasn’t greater than the driver’s.

- “Every Corner is a Crosswalk” Awareness: Many drivers (and pedestrians) aren’t fully aware that unmarked crosswalks exist. For example, crossing at an intersection with no painted lines is legal for pedestrians in Oregon. If you were hit in such a scenario, make sure to inform the insurance or court that this was an unmarked crosswalk and cite ORS 811.028 which gives you right-of-way. Police reports sometimes mistakenly list “pedestrian error” if not at a marked crosswalk, but the law is on the pedestrian’s side at standard intersections.

- Injuries and Damages: Pedestrians commonly suffer broken bones, head injuries, or internal injuries when struck even at moderate speeds. These cases often involve substantial medical treatment (and sometimes permanent injury). If the driver was clearly at fault, their insurance should pay not only medical bills and lost wages, but significant compensation for pain, suffering, and loss of enjoyment of life. If the injuries are life-changing (brain injury, loss of limb, etc.), the damages can reach into hundreds of thousands or millions, especially if long-term care or assistance is needed.

- Hit by a Bicyclist or E-Scooter: Note that not all pedestrian accidents involve cars – sometimes bicyclists or electric scooter riders can hit pedestrians. In those cases, a pedestrian can have a claim against the cyclist (who might be covered by their homeowner’s or renter’s insurance, or a special cyclist liability policy if they have one). Portland’s streets, for example, have many cyclists and scooter riders. If you’re hit as a pedestrian, gather the rider’s info similar to a car accident. Police might not always respond to a bike-pedestrian collision unless someone is seriously hurt, so you may have to rely on exchanging information.

- Uninsured Motorist for Pedestrians: If you are a pedestrian hit by a car and the driver has no insurance or it was a hit-and-run, your own auto policy’s UM coverage can cover you (just like with cyclists). Also, your PIP coverage from your auto policy will cover your injuries as a pedestrian. Many people don’t realize this – they think “I wasn’t in my car, so my car insurance doesn’t apply.” But it does; auto policies generally cover you if struck as a pedestrian. This can be a lifesaver for paying medical bills and getting compensation if the driver is unidentified or uninsured.

Liability Issues in Pedestrian Cases: One common defense is “the pedestrian was wearing dark clothes at night and was not visible.” Oregon law doesn’t require pedestrians to wear bright clothing, but at night this can come up in assessing negligence. A driver might say they couldn’t see the person until too late. If you were hit at night, any detail like street lighting, reflective clothing, etc., can matter. Another issue: intoxication. If an intoxicated pedestrian walks into traffic, that impairment can be considered their own negligence. Each case will balance the driver’s duties with the pedestrian’s actions.

Because pedestrians are so vulnerable, Oregon has stiff penalties for drivers who fail to yield. If a driver is found to have violated crosswalk laws and caused serious injury or death, they can even face criminal charges or license suspension in addition to civil liability. For your civil case, focus on gathering witness statements (other drivers or pedestrians who saw it), any camera footage (surveillance from nearby businesses or traffic cams), and physical evidence (skid marks, point of impact on the car) to reconstruct what happened.

Rideshare (Uber/Lyft) Accidents

With the rise of Uber and Lyft, car accidents can involve rideshare vehicles, which adds layers of insurance complexity. Whether you were a passenger in a rideshare or hit by an Uber/Lyft driver (or you are a rideshare driver), here are special considerations:

- Insurance Coverage Depends on Driver’s Status: Rideshare companies provide different insurance coverage in three distinct periods:

- Period 1: The rideshare driver is logged into the app and available for rides, but has not accepted a ride request yet. In this period, the rideshare company (Uber/Lyft) provides limited liability coverage: typically $50,000 per person, $100,000 per accident bodily injury, and $25,000 property damage (50/100/25). This is contingent coverage – if the driver has personal auto insurance that covers the incident, that might come first, but most personal policies exclude coverage when driving for hire, which is why Uber/Lyft’s period 1 coverage exists.Period 2: The driver has accepted a ride request and is on the way to pick up the passenger.Period 3: The passenger is in the car (ride in progress) until drop-off.

For Periods 2 and 3, Uber and Lyft provide a $1 million liability insurance policy for any accident the rideshare driver causes. They also typically provide $1 million in UM/UIM coverage for accidents where an uninsured (or hit-and-run) driver hits the rideshare during an active ride. Additionally, in periods 2 and 3, the rideshare company usually provides collision coverage for the driver’s vehicle (if the driver has collision on their personal policy), subject to a deductible.

Why does this matter? If you are in an accident involving an Uber or Lyft, identifying which “period” the driver was in is crucial to know what insurance applies.- If you were struck by an Uber that was in Period 2 or 3 (driver en route to or carrying a passenger), then Uber’s $1M policy should cover your damages as an injured third party.

- If you were struck by an Uber in Period 1 (app on, no passenger yet), then only the $50/100/25 coverage is available from Uber’s side, which might not fully cover a serious injury. You might then have to rely on your own UM coverage if that’s insufficient.

- If you were a passenger in a rideshare, you are covered by their $1M policy if another vehicle caused the crash (that policy can act as UM if the other driver is uninsured or hit-and-run), or if the rideshare driver caused it, their liability to you is covered by the $1M as well. In any case, as a paying passenger you are not at fault, so you should recover from one or both drivers’ insurances.

- Multiple Insurance Claims: Rideshare accidents often involve multiple insurers. For example, you’re a passenger and another car runs a red light hitting you – you could pursue the other car’s insurer, and simultaneously Uber/Lyft’s UM coverage in case the other car is underinsured. Or if your Uber driver caused it, you might have a claim against Uber’s insurer and possibly the driver’s personal insurer (though again, personal insurance usually excludes coverage during commercial use). It can get complicated who pays and in what order. Usually, the rideshare company’s insurance will not pay out unless it’s clearly their driver’s fault or the other insurer has paid its max. Coordination between insurers can delay things. A lawyer can help navigate this and ensure claims are filed appropriately with each insurer.

- Notice and Reporting: If you’re in a crash with a rideshare vehicle, report it through the app as well. Uber and Lyft have in-app reporting for accidents. Doing so will trigger their insurance claims process. If you’re a passenger, also make sure to get the police report and the personal insurance info of any other driver involved, not just rely on the app report.

- Rideshare Driver as Plaintiff: If you are a rideshare driver and you’re hit by someone else, you also have rights. In periods 2 and 3, you have the company’s $1M UM coverage if needed. In period 1, your own policy likely doesn’t cover (unless you bought a rideshare endorsement), so you lean on Uber/Lyft’s 50/100/25 coverage or the other driver’s insurance if they’re at fault. Rideshare drivers should strongly consider getting a rideshare insurance endorsement on their personal policy to cover that gap in period 1. Some insurers in Oregon offer it. If not, an accident in period 1 could leave the driver with only that limited policy and perhaps personal exposure if damages exceed it.

- Legal Liability of Rideshare Companies: Generally, Uber and Lyft classify their drivers as independent contractors, not employees. This can shield the companies from direct liability in some cases (they will say the $1M insurance covers the liability). However, there are scenarios where Uber/Lyft might be directly sued – for example, if a driver assaulted a passenger or had a known history of dangerous driving and they failed to screen them. For an ordinary negligence crash, usually only the driver is named and the insurance handles it. But know that the $1M policy is there specifically to cover incidents in which the driver is at fault – effectively protecting both the driver and the company.

- Different Procedures: In a typical two-car accident, you exchange info and deal with insurance. In a rideshare accident, if you’re the passenger, you should also screenshot ride details from your app, and you might even have some support through the app (Uber’s support may reach out). It doesn’t change the fundamentals (still gather evidence, etc.), but you have an extra party (the rideshare company’s insurer) to deal with. Keep in mind the driver might be nervous – an accident could jeopardize their status on the platform.

- Injuries to Rideshare Passengers: If you were hurt as a passenger, you are in a good position legally since you clearly have no fault. Document your injuries and treatment, and know that Uber/Lyft’s insurance will cover your medical bills and other damages, up to that $1M. They might even offer some medical payment benefit upfront (not always, but sometimes rideshare insurers have something akin to PIP for passengers). Ask about it.

In summary, rideshare accidents require sorting out insurance coverage carefully. The good news is Oregon mandates substantial coverage when carrying passengers. But the bad news is it can be confusing to pursue, and sometimes insurers may disagree on who pays what (for example, if an Uber driver is in an accident with a Lyft driver, their insurers might point fingers). If you find yourself tangled in a rideshare-related crash, consider consulting an attorney who has handled these – they will know the drill on contacting the right insurance carriers and pressing the correct claims.

7. Resources & Next Steps

Recovering from a car accident can be daunting, but you’re not alone. Oregon provides various resources to help accident victims, and knowing who to contact or where to find information is invaluable. Below is a list of helpful resources, contacts, and next steps to consider after an accident in Oregon:

Emergency and Law Enforcement Contacts:

- Emergency Services: In any emergency situation (accident with injuries, unsafe conditions, etc.), call 911 immediately. This will summon police, and if needed, fire/EMS to the scene.

- Local Police Departments: If you need to request a copy of a police report or follow up on an accident investigation, contact the city police or county sheriff where the accident occurred. For example:

- Portland Police Bureau (Non-emergency line): 503-823-3333.

- Oregon State Police (OSP) Dispatch: *OSP or 677 from a mobile phone (for highway incidents).

- Salem Police Non-emergency: 503-588-6123.

- Eugene Police Non-emergency: 541-682-5111. (Visit the department’s website for more contact options and information on obtaining accident reports.)

- Oregon State Police Report Request: If OSP responded to your crash (common for highway accidents), you can request the Oregon Police Traffic Crash Report through OSP’s records unit.

Oregon DMV and Accident Reporting:

- Oregon DMV Accident Report Form: If your accident meets the reporting criteria (injury, death, $2,500+ damage), you must submit the Oregon Traffic Accident and Insurance Report to DMV within 72 hours oregon.gov oregon.gov. The form can be downloaded from the DMV website or obtained at any DMV office. Online Resource: [Oregon DMV – Collision Reporting and Accident Report Form】douglascountyor.gov (includes instructions and the form itself).

- DMV Contact: Oregon DMV Accident Reporting Unit, Phone: 503-945-5098 (to ask questions about accident report requirements). Address (for mailing forms): DMV Crash Reporting Unit, 1905 Lana Ave NE, Salem, OR 97314.

- Oregon Law (ORS) Reference: ORS 811.720 outlines the requirement to report accidents to DMV and the conditions. (For legal reference see Oregon Revised Statutes on accident reporting.)

Medical Resources:

- If you need medical evaluation after an accident and it’s not an emergency, you can visit any urgent care or hospital. Some Oregon hospitals known for trauma care:

- OHSU Hospital (Portland): Level 1 trauma center – excellent for serious injuries.

- Legacy Emanuel Medical Center (Portland): Level 1 trauma center.

- Salem Health (Salem Hospital): Major hospital in Mid-Willamette Valley.

- Sacred Heart Medical Center at RiverBend (Springfield/Eugene area): Level 2 trauma center serving Eugene area.

- Follow-up Care: Oregon has many physical therapy clinics, chiropractors, and specialists. If you have PIP, you can choose your providers. The Oregon Board of Chiropractic Examiners and Oregon Physical Therapy Association can help locate licensed practitioners.

- Mental Health: Don’t overlook the emotional impact of an accident. Therapists or support groups can be helpful, especially if you experience PTSD-like symptoms (flashbacks, anxiety driving).

Legal Resources: